Trisus Healthcare Intelligence surfaces process variations across the continuum of care that impact profit margin by allowing organizations to see operational and financial data at a patient level, the way clinicians approach care delivery. The power in this data lay in an organization’s ability to use these insights to drive improvement that not only enhances clinical outcomes, but also financial performance – providing margin for your mission.

Objectives

- Analyze DRGs for obstetrics and neonatal services to identify a sample with significant margin loss per case

- Within the sample, identify process improvement projects to impact quality of care and financial metrics

- Provide margin projection to remain competitive and viable within the local market

Key Data Challenges

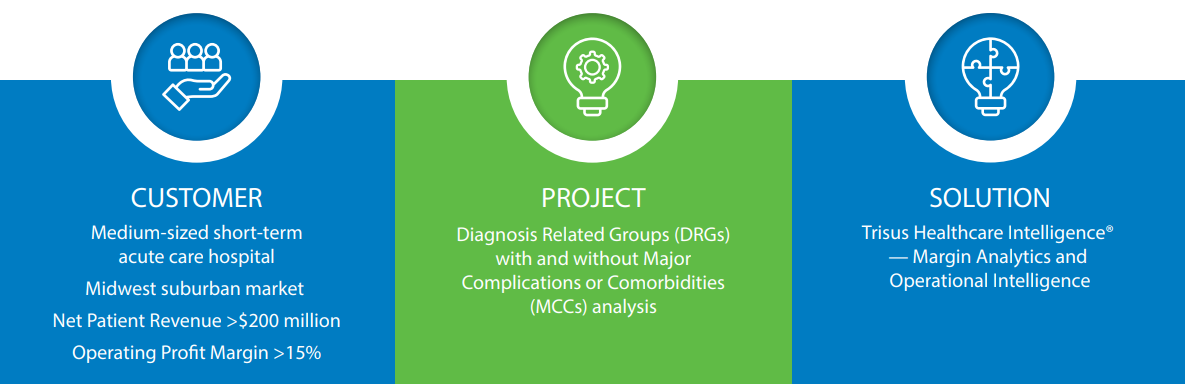

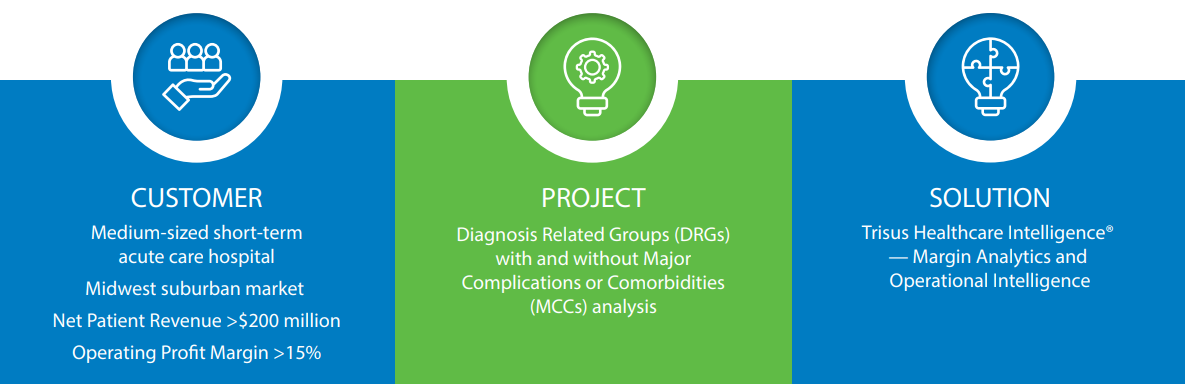

Diagnosis Related Group (DRG) reimbursement – fixed payments for care provided for a specified medical condition – limits the ability of healthcare providers to complete crucial steps to achieve the quality patient outcomes and optimal financial performance demanded in a value-based healthcare economy:

- Calculate and track true cost and efficacy of all episodes of care

- Analyze payment data to identify opportunities to improve the accuracy of claims and optimize reimbursement

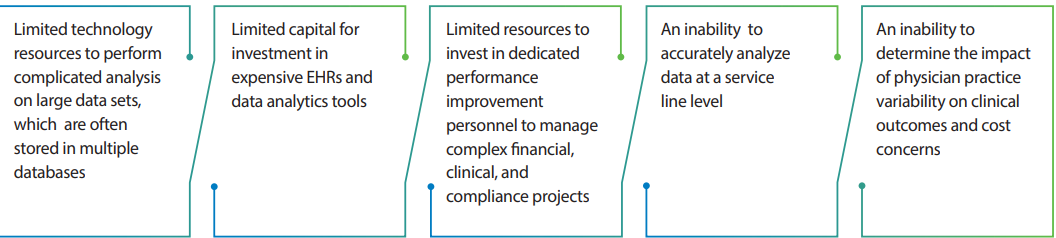

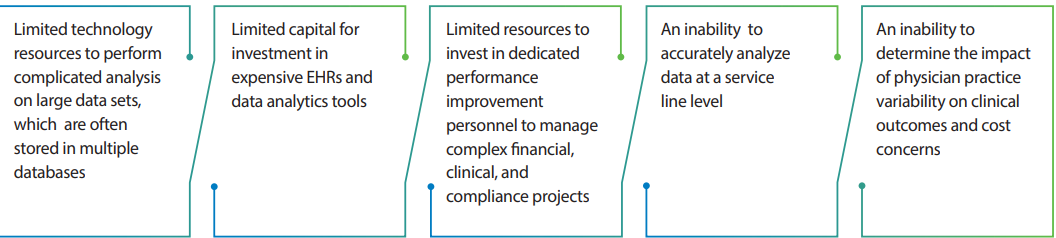

As healthcare markets become increasingly competitive, it becomes more difficult to maintain and improve the margin required to fulfill a clinical mission, particularly for smaller hospital. Challenges often faced by smaller hospitals include:

“THI has allowed us to quickly and accurately analyze service line cost and profitability, allowing the organization to assess opportunities for cost reduction or increased reimbursement.

VP, CFO

”

Results

A review was performed of all DRGs that were losing significant margin per case. Two DRGs were noted for further investigation: MS-DRG 947 and MS-DRG 948, Signs and Symptoms with or without MCC.

These DRGs are additionally noteworthy as they are unspecified in nature, meaning the specific etiology is indeterminate. The most common principal diagnosis that relates to these DRGs are weakness or malaise-related diagnoses.

During the fiscal year, there were 173 of these cases, which represented an estimated expected loss (excluding indirect costs) of $670,000.

- A review of the secondary diagnoses for these patients revealed two predominant illnesses that could have been leveraged for a different DRG

- The leading secondary diagnoses for these patients could have led to the billing of two alternative DRGs, namely DRG 189, Pulmonary Edema and Respiratory Failure or Chronic Respiratory Failure, and DRG 193, Simple Pneumonia without Pleurisy

- Each of these DRGs would have allowed for a higher case mix index, which indicates a more complex and resource-intensive case load, and subsequently, higher reimbursement

In addition to the opportunity to increase revenue by selecting a higher acuity DRGs, an opportunity to reduce costs also existed. A comparison was subsequently performed to evaluate the average length of stay (ALOS) for this patient population against the average Centers for Medicare and Medicaid Services (CMS) ALOS for these DRGs.

It was determined that for both DRGs, the hospital ALOS was between 4.5 - 5 days longer than the CMS expectation. This further indicated that the hospital was experiencing a significant actionable variation contributing to the negative margin. A reduction in the ALOS to the CMS average would represent an additional cost reduction opportunity of $735,000.

The total margin opportunity associated with this population is $850,000. The cost savings represent a 50% reduction in cost and the revenue opportunity represents a 12% increase across the population.