Chair’s Introduction

On behalf of the Board, I am pleased to present our Corporate Governance Report for the year ended 30 June 2024 in the context of the UK Corporate Governance Code 2018 (‘the Code’), our chosen corporate governance framework. The Board believes that, with high standards of corporate governance, including shareholder engagement and engagement with other stakeholders, are critical to the success of our strategy. outlined in the Operational Review section of our 2024 Annual Report, and to delivering long-term, sustainable shareholder value.

Purpose, Values and Culture

Our Purpose is to help transform the business of healthcare through the profound impact our solutions deliver, enabling our customers to provide quality care to their communities. We continue to demonstrate that The Craneware Group is uniquely placed with our independent standing in our end market, and with our solutions across healthcare finance and 340B continuum, to support US healthcare providers in their mission to serve their communities. Supporting our customers, and the phenomenal work they do for their communities, continues to be our top priority and this ethos is evident throughout The Craneware Group.

I would like to thank all colleagues within the team for their unwavering commitment, enthusiasm and passion – together we uphold our Purpose. The Group is supportive of, and recognises the importance of diversity, including gender, ethnicity, nationality, skills and experience. This is evident from the diverse, inclusive and breadth and depth of skills and experience within the team and we aim to ensure that we continue to attract diverse talent into The Craneware Group.

Supporting our Purpose is our Framework consisting of our core values which are described further in the Environmental, Social and Governance (ESG) Statement within our 2024 Annual Report. The Board continues to monitor how the Purpose, vision, strategy and values align to the Group’s culture.

Employee voice and engagement

Our People are at the centre of our collective commitment to our Purpose and as a Board we are aware of our responsibilities to prioritise their wellbeing, including working arrangements, conditions and reward, in support of our culture. The Board appreciates the benefits from effective employee engagement mechanisms, including honest and constructive feedback from employees, and these are referred to within this Corporate Governance Report and further described within the ESG Statement section of our 2024 Annual Report. We continue to see great benefit from employee interaction, communication and collaboration and the Board endorses the Operations Board’s efforts to increase the opportunities for collaboration both within and across teams.

Section 172 and Stakeholder Engagement

A key focus of the Code is the requirement to report on how the interests of the Group’s stakeholders and the matters set out in section 172 of the Companies Act 2006 have been considered in Board discussions and decision making. It is also important for the Board to keep stakeholder engagement mechanisms under review so that they remain effective. The Board’s section 172 (1) statement and details of our engagement with stakeholders can be found on pages 56 to 63 of our 2024 Annual Report.

Environmental, Social and Governance (ESG)

Our Purpose inherently prioritises the ‘Social’ emphasis for our Environmental, Social and Governance (ESG) endeavours. For many years The Craneware Group has established (and continues to encourage) many sustainability initiatives which benefit various stakeholder groups and we are committed to continue, in alignment with our Purpose, to operate in a way that allows us to meet the needs of our stakeholders and have a positive impact on the communities in which we operate and wider society.

The Board is supportive of the Group’s ESG Committee, chaired by Issy Urquhart, which has made great progress with overseeing various initiatives within the context and the framework of our three key ESG Focus Areas. The Non-Financial and Sustainability Information Statement and ESG Statement sections of our 2024 Annual Report provide a comprehensive synopsis of the range of activities in FY24 some of which are ongoing in FY25 within the Diversity, Equity and Inclusion and other sustainability projects. It is pleasing to see the involvement of many employees with various ESG efforts, including those driven by our Employee Advisory Group. The support and enthusiasm for this range of activities is appreciated and highlights the breadth of issues that matter to our team.

The ESG Committee conducted a more detailed climate scenario analysis during the year, with the valuable support of other colleagues, which assisted to provide a more extensive appraisal of potential climate-related risks and opportunities. We continue to work on the baselining of our environmental data so that we have an appropriate foundation to establish targets along the pathway to net zero emissions. This baseline data should also assist with the compilation of appropriate key performance indicators for monitoring the reduction in our impact on the environment and for managing climate-related risks. We are committed to make further progress with this during the year ending 30 June 2025.

Board composition

The Board, and Craneware as a whole, has benefitted significantly over the past ten years from the considerable US Healthcare sector experience, governance credentials, dedication and support provided by Colleen Blye and Russ Rudish. The independent guidance provided by Colleen and Russ has been invaluable, particularly in their respective Chair roles within the Board’s Audit and Remuneration Committees and with Colleen serving as our Senior Independent Director for many years.

We thank Colleen and Russ for their significant contribution to The Craneware Group and respect their decisions not to stand for re-election as directors of the Company at the AGM to be held in November 2024. We appreciate their dedication to ensure a smooth transition for new independent directors whom we are seeking to recruit in the coming months. We aim to attract a diverse pool of candidates, with relevant skills, experience and knowledge, for any senior appointments. As a Board, identifying the prerequisite skill sets for the highly regulated and complex environment of US Healthcare has taken precedent over setting and specific diversity targets for the Board and senior management team. All appointments will ultimately be made on merit.

Board evaluation

We conducted a Board evaluation in the financial year. The helpful contributions and engagement provided by my fellow directors through this process was appreciated and I am happy to report that the overall conclusions from the evaluation were positive. An overview of the process is provided within this Corporate Governance Report.

Annual General Meeting (‘AGM’)

The Board recognises that the AGM is an important event for all shareholders. The arrangements for the AGM, to be held in November 2024, are outlined in the Notice of AGM and we look forward to welcoming shareholders at the AGM.

The year ahead

We are well progressed in our efforts to identify and appoint new non-executive Directors to take the place of Russ and Colleen. Our short list of candidates bring with them a wealth of experience including direct experience of the ongoing challenges faced by US hospitals and Healthcare, more generally. We look forward to working with our new Board dynamics and continuing to see The Craneware Group support US hospitals and Healthcare as they provide care to their communities.

We thank our shareholders, our other stakeholders, including our employees, for their ongoing support during this past year and for the future as we together uphold the Purpose of The Craneware Group.

Will Whitehorn

Chair

2 September 2024

Corporate Governance Report

The Board of Directors ("the Board") has always recognised the importance and value of high standards of corporate governance and has elected to adopt the UK Corporate Governance Code 2018 (the ‘Code’) as its corporate governance framework but it is aware that this Code has been drafted in the context of larger, main market listed companies.

The Board is pleased to report how it has applied the principles and complied with the provisions of the Code in line with best practice and in view of the size of the Group. This Report sets out how it has complied with the individual provisions and applied the ‘spirit’ of the UK Corporate Governance Code 2018 as a whole and explains any areas of non-compliance with the provisions of the Code. The UK Corporate Governance Code 2018 is available from the Financial Reporting Council at www.frc.org.uk.

Overview: Application of the UK Corporate Governance Code 2018 (the ‘Code’)

The Board seeks to continue to ensure the overarching objective that the governance of the Company contributes to its long-term sustainable success, aligned to its purpose, and achievement of wider objectives, including the Company and the Group’s contribution to the communities in which it operates and wider society. The Board recognises, as stated in the Code, that achieving this depends on the way it applies the spirit of the Principles of the Code. The Company is a smaller company for the purposes of the Code and, as such, certain provisions of the Code are judged to be disproportionate or less relevant in its case. Where the Company does not comply with any specific Code provision then this is highlighted and explained in this report.

Compliance statement

The Board has complied with the spirit of the UK Corporate Governance Code 2018 and applied the principles and complied with the provisions of the Code throughout the year ended 30 June 2024 (‘FY24’), with the exception of the following areas that the Board believes are not appropriate for a Group of our size:

- Provision 17: due to the size of the Board, a separate nomination committee has not been established. Instead, these duties have been fulfilled by the Board as a whole.

- Provision 36: concerning the development of a formal policy for post-employment shareholding requirements. Post-employment shareholding policies continue to be the exception for AIM Companies. The Remuneration Committee continues to keep this area under review but considers that, whilst no formal post-employment shareholding policy for executive Directors is in place, its current approach is acceptable. There is a current required shareholding guideline applicable to executive Directors and senior management and that guideline has already been significantly exceeded by two of the executive Directors. In addition, there is a post-vesting holding period applicable to Long Term Incentive awards granted since October 2020 to the executive Directors and senior management. These policies are considered to promote long-term shareholdings by executive Directors that support alignment with long-term shareholder interests although they do not include post-employment shareholding requirements; and

- Two of the seven elements of Provision 41: Craneware plc, being an AIM listed company, is not required to comply with the Directors’ Remuneration Report regulations however the Company does aim to comply with the spirit of all of Provision 41 of the Code in so far as the Board considers is appropriate for the size of the Company and therefore it provides a Remuneration Committee’s Report, with the FY24 Report on pages 95 to 113 of our 2024 Annual Report. During the year there was no specific engagement with employees in respect of executive Director remuneration. However, the same policy of paying at median (based on benchmark data) applies across the whole Group.

Regarding one of the other elements of Provision 41 of the Code, the reference to internal and external measures for executive Director remuneration review and assessment is not presented within the Remuneration Committee’s Report due to the deferral of benchmarking during the previous four financial years. With the independent benchmarking study for executive Director remuneration completed in FY24, external measures have been utilised for that assessment. Going forward, it is anticipated that internal and external measures would be tracked by the Remuneration Committee for executive Director remuneration comparison purposes.

Board Leadership and Company Purpose

The role of the Board

The Board is primarily responsible for the overall conduct of the Group’s business and for promoting the long-term success of the Group. The Board is collectively accountable to shareholders for its proper management. The Board must balance this responsibility with ensuring that the Directors have regard for key stakeholders and that there is sufficient time, information and understanding to properly take into account those stakeholders’ interests when making decisions and considering their long-term implications. The Board recognises that effective engagement with key stakeholders, including employees, customers, shareholders, the community, bank finance providers and suppliers, is a core component of long-term sustainability and success. Stakeholder Engagement information is set out on pages 61 to 63 of our 2024 Annual Report. The Directors consider, both individually and collectively, that they have taken the factors, set out in s172(1)(a) to (f) of the Companies Act 2006, into account when exercising their duty to promote the success of the Group and of the Company during the year. The Board’s Section 172(1) Statement is on pages 56 to 60 of our 2024 Annual Report and it includes examples of how those matters have been considered in significant decisions of the Board.

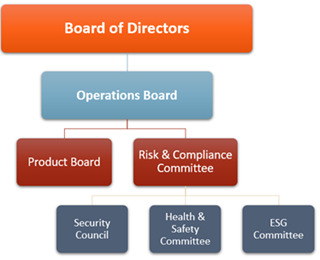

The Board delegates authority for the day to day management of the Group to the Chief Executive Officer and the rest of senior management within the Operations Board, under a set of delegated authorities. The Board is well supported by the Group’s Operations Board and a broader senior management team, who collectively have the qualifications and experience necessary for the day to day running of the Group. The Operations Board is chaired by the Chief Executive Officer and also comprises the Chief Financial Officer, the Chief People Officer and six further members of the Senior Management Team.

The governance structure is summarised below.

Purpose, vision, strategy, values and culture

The Board leads and establishes the Group’s purpose, vision, strategy and values and ensures that they are being carried out in practice across the business. The Board provides leadership across the Group and applies a governance framework to ensure that this is delivered effectively with appropriate control mechanisms.

Our Purpose forms the basis of Group-wide strategic initiatives each year. Our Purpose is to transform the business of healthcare through the profound impact our solutions deliver, enabling our customers to provide quality care to their communities. Our culture is the way that we work together and is fundamental to how we operate. The Board has a fundamental role in shaping our corporate culture defined by our values and purpose. The Board assesses and monitors the Group’s culture through regular interaction with management and other colleagues to ensure that its policies, practices and behaviours are aligned with the Group’s purpose, vision, strategy and values. Employee engagement mechanisms are referred to below within the ‘Stakeholder Engagement’ section.

The Board is responsible for delivering value for shareholders by setting the Group’s strategy and overseeing its implementation by the Operations Board. Our strategy and business model are explained within the Strategic Report on pages 8 to 16 of our 2024 Annual Report. The Board meets at least annually to review the Group’s strategy, drawing on the wide and varied experience of the Board members (as outlined below within the ‘Composition of the Board’ section), including detailed healthcare sector knowledge. The Board meets regularly to discuss and agree on the various matters brought before it, including progress with the agreed strategy and the Group’s trading results.

There is a formal schedule of matters reserved for the Board, which includes approval of the Group’s strategy, annual strategic initiatives and related business plans, acquisitions, disposals, business development, annual reports and interim statements, plus any significant financing or funding related matters as well as significant capital expenditure plans. As part of this schedule, the Board has clearly laid out levels of devolved decision making authority to the Group’s Operations Board.

Board Composition and Division of Responsibilities

Board of Directors

Throughout the financial year ended 30 June 2024 and until the date of approval of this report the Company’s Board comprised of: its Chair, Will Whitehorn; three executive Directors: Keith Neilson, Chief Executive Officer; Craig Preston, Chief Financial Officer; and Issy Urquhart, Chief People Officer; along with five further non-executive Directors (each of whom the Board considers to be independent), Colleen Blye (Senior Independent Director), Russ Rudish, Alistair Erskine, David Kemp and Anne McCune. Detailed biographies of all Directors are contained in the Board of Directors section of this website.

A summary of the composition of the Board throughout the year ended 30 June 2024 is:

Period | Composition of the Board | ||

| Chair (Independent on Appointment) | Executive Directors | Independent^ Non-executive Directors |

Year ended 30 June 2024 | 1 | 3 | 5 |

^The Board considers that all of the non-executive directors are independent in character and judgement, notwithstanding their tenure on the Board, as described further below within ‘The Composition of the Board’ section.

Division of Responsibilitie

The Board has established clearly defined and well understood roles for the Chair of the Company and the Chief Executive Officer. A summary of the main responsibilities of these roles, and also that of the Senior Independent Director, is contained in the table below.

Role | Summary of Responsibilities |

Chair | The Chair is responsible for the leadership of the Board, ensuring its effectiveness in directing the Company and the Group, and setting its agenda. The Chair is also responsible for upholding high standards of corporate governance and for promoting a culture of openness and debate facilitating constructive Board relations and the effective contribution of all Non-Executive Directors to provide constructive support and challenge to the executive Directors and senior management. The Chair ensures that the Board receives accurate, timely and clear information. In addition, the Chair’s responsibilities include to ensure that the Board is aware of the views of shareholders and other stakeholders. |

Chief Executive Officer | The Chief Executive Officer (CEO) ensures that the strategic and financial objectives, as agreed by the Board, are delivered upon in addition to ensuring the effective implementation of the Board’s decisions. To facilitate this, the CEO chairs the Group’s Operations Board which manages, subject to the clearly defined authority limits, the day-to-day operation of the Group’s business in an ethical and sustainable manner, aligned to the culture of The Craneware Group. Maintaining an effective framework of internal controls and risk management are also within the responsibilities of the CEO. In addition, the CEO is responsible for leading, motivating and monitoring the performance of the Group’s senior management. |

Senior Independent Director | The Senior Independent Director provides a sounding board for the Chair, in addition to supporting governance matters, as well as providing an additional channel of contact for shareholders, other Directors or employees, if the need arises. |

The Chair

Will Whitehorn was appointed Chair of the Board on 1 January 2020 and was independent on appointment, in accordance with Provisions 9 and 10 of the Code.

Non-Executive Directors

The Board has appointed Colleen Blye as Senior Independent Director. The responsibilities of this role are outlined in the ‘Division of Responsibilities’ section above.

The non-executive Directors assist in the development of strategy and monitor its delivery within the Company’s established risk appetite. They are responsible for bringing sound judgement and objectivity to the Board’s deliberations and decision-making process. In addition, the non-executive Directors constructively challenge, support and review the performance of executive Directors. As Board committee members the non-executive Directors also, amongst other matters within the terms of reference of each committee, review the integrity of the Group’s financial information and set the remuneration of the executive Directors.

In addition to matters outlined above, there is regular communication between executive and non-executive Directors including, where appropriate, updates on matters requiring attention prior to the next Board meeting. The non-executive Directors meet, as appropriate but no less than annually, without executive Directors being present and further meet annually without the Chair present.

The non-executive Director contracts are available for inspection at the Company’s registered office and are made available for inspection both before and during the Company’s Annual General Meeting.

The Composition of the Board

The Board reviews its composition (and that of its committees) regularly, taking into consideration various factors including: the balance of independent directors, requisite skills, knowledge and experience within the Board and diversity. The composition of the Board has been designed to give a good mix and balance of different skill sets, including significant experience in:

- healthcare sector;

- high growth companies;

- software sector and analytics;

- entrepreneurial cultures;

- senior financial reporting;

- strategic and operational human resource management;

- both UK and US companies;

- acquisitions;

- integration of acquired businesses; and

- other listed companies.

Through this mix of experience and skills, the Board and the individual Directors are well positioned to set the strategic aims of the Company as well as drive the Group’s values and standards throughout the organisation, whilst remaining focused on their obligations to shareholders and meeting their statutory obligations.

Throughout the year ended 30 June 2024 at least half the Board, excluding the Chair, were non-executive Directors whom the Board considers to be independent. The Board reviews, on an annual basis, the independence of each non-executive Director. In making this assessment, in addition to considering Provision 10 of the Code, the Board determines whether the Director is independent in character and judgement and whether there are relationships or circumstances which are likely to affect, or could appear to affect, the Director’s judgement.

In regards to all of the non-executive Directors, the Board has not identified any matters that would affect their independence; the Board considers that all of the non-executive Directors are independent in character and judgement and free from any business or other relationship that could materially interfere with exercising that judgement. The Board acknowledges the factors contained in Provision 10 of the Code. Notwithstanding that both Colleen Blye and Russ Rudish have served on the Board for more than nine years, having been appointed to the Board in November 2013 and in August 2014 respectively, the Board considers that both Colleen and Russ are independent in character and judgement.

The Board has carefully considered the role Colleen has within the Board and ongoing contribution, including in Colleen’s role as the Senior Independent Director being one of the four senior Board positions. The Board concluded the knowledge and independent challenge Colleen brings to the Board, including discussions at Board meetings, continues to contribute great value to the Board and as such it is appropriate to retain Colleen’s independent services in the Senior Independent Director role at this time. The Board has performed a similar review of Russ’ independence and concluded that Russ continues to be independent.

The Board keeps the composition of the Board and its committees under review, including its continued independent balance.

The Board has established an Audit Committee and a Remuneration Committee, details of which are provided below. The Board does not have a separate Nomination Committee as the Company has incorporated this function within the remit of the entire Board. Although not in compliance with Provision 17 of the Code, the Board considers this to be an appropriate arrangement in view of the size of the Group.

The Board keeps the composition of the committees under review. The membership of both of the Committees changed during the year as explained below.

Audit Committee members | Remuneration Committee members |

From 1 July 2023 to 16 November 2023 David Kemp (Chair) Colleen Blye Alistair Erskine From 16 November 2023 to 30 June 2024 David Kemp (Chair) Alistair Erskine Anne McCune | From 1 July 2023 to 16 November 2023 Russ Rudish (Chair) Colleen Blye Alistair Erskine From 16 November 2023 to 30 June 2024 Russ Rudish (Chair) Alistair Erskine Anne McCune |

Attendance of Directors at scheduled Board and Committee meetings convened in the year, along with the number of meetings that they were invited to attend, are set out below:

Where any Director has been unable to attend Board or Committee meetings during the year, their input has been provided to the Company Secretary ahead of the meeting. The relevant Chair then provides a detailed briefing along with the minutes of the meeting following its conclusion.

The shareholder voting, in respect of each of the resolutions tabled at the Company’s Annual General Meeting (‘AGM’) held on 16 November 2023, passed all of the resolutions. However, a number of the votes received opposed the resolution in respect of the reappointment of Colleen as a director of the Company. Following consultation with shareholders during their AGM voting consideration, the Board identified certain concerns regarding the composition of the Board’s Audit and Remuneration Committees. Therefore, with effect from 16 November 2023, Anne McCune replaced Colleen Blye as a member of both the Audit and Remuneration Committees.

Colleen and Russ have each informed the Board of their intention not to stand for re-election as directors of Craneware plc at the Company’s AGM to be held in November 2024. The Board is in the latter stages of reviewing replacement independent non-executive director candidates. The role of Senior Independent Director and the composition of our Board committees, particularly the position of Chair of the Remuneration Committee, following the AGM in 2024, is being considered by the Board.

Board Appointments and Evaluation

Appointments to the Board

Board composition is regularly reviewed to ensure the requisite mix of skills, business experience and diversity is achieved and maintained, appropriate for the Group, as well as the balance within the Board of independent non-executive directors. When a new appointment to the Board is to be made, consideration is given to the particular skills, knowledge and experience that a potential new member could add to the existing Board composition. A formal process is then undertaken, usually involving external recruitment agencies, with appropriate consideration being given, in regard to executive appointments, to internal and external candidates. Before undertaking the appointment of a Director, the Board establishes that the prospective candidate can give the time and commitment necessary to fulfil their duties, in terms of availability both to prepare for and attend meetings and to discuss matters at other times. This includes, prior to appointment, significant existing commitments being disclosed and assessed along with an indication of time commitment involved.

Following the decision by both Colleen and Russ not to stand for re-election as non-executive directors of the Company at the Company’s AGM to be held in November 2024, in early FY25 the Board commenced a search and recruitment process for new independent non-executive directors. Details of that process shall be provided in the annual report for the year ending 30 June 2025.

Conflicts of interest

Any conflicts, or potential conflicts, of interest are disclosed and assessed prior to a new Director’s appointment to ensure that there are no matters which would prevent that person from accepting the appointment. The Group has procedures in place for managing conflicts of interest and Directors have continuing obligations to update the Board on any changes to these conflicts. This process includes relevant disclosure at the beginning of each Board meeting. If any potential conflict of interest arises, the Articles of Association permit the Board to authorise the conflict, subject to such conditions or limitations as the Board may determine. The Board is satisfied that there is no compromise to the independence of, and nothing which would give rise to conflicts of interest for, any of the Directors who serve as directors on other company boards or who hold other external appointments.

Diversity

The Group is supportive of, and recognises the importance of diversity, including gender, ethnicity, nationality, skills and experience and professional, educational and socio-economic background. This is evident from the diverse, inclusive and breadth and depth of skills and experience within the team at The Craneware Group. While not in favour of setting specific targets, in the event that a Board position is required to be filled, during succession planning, the Board aims to ensure that the search process is sufficiently inclusive to encourage applications from diverse candidates with relevant skills, experience and knowledge, and that the selection process is fair and transparent.

The Board comprised 33% female and 67% male directors throughout the year ended 30 June 2024. The Senior Independent Director (one of the four senior Board positions) is female. At the end of the financial year, across The Craneware Group, our team comprised 47% female and 53% male employees (at 30 June 2023: 47% female and 53% male employees). At Operations Board plus vice president level, the composition is approximately 39% female and 61% male (at 30 June 2023: 34% female and 66% male employees). Further information regarding Diversity, Equity and Inclusion is contained within the ESG Statement on pages 46 and 47 of our 2024 Annual Report.

Commitment

All Directors recognise the need to allocate sufficient time to the Company for them to be able to meet their responsibilities as Board members. All non-executive Directors’ contracts include minimum time commitments; however, these are recognised to be the minimums.

Details of the other directorships held by each Board member are provided in the Directors’ biographies in the Board of Directors section of this website. The Board has evaluated the time commitments required by these other roles and does not believe it affects their ability to perform their duties with the Company. Prior approval of the Board is required in advance of executive Directors undertaking external appointments. In February 2024, I Urquhart was appointed as a non-executive director of Concurrent Technologies plc whose shares are listed on the AIM market of the London Stock Exchange. The other executive Directors do not hold any outside appointments with any other publicly traded company.

Succession Planning

The Board as a whole recognises its responsibility to ensure that appropriate plans are in place for orderly succession to the Board and has plans in place for any unforeseen circumstances regarding the executive Directors. The Board considers succession planning periodically, usually as part of its evaluation exercise. The composition of the Board has been carefully considered with these factors in mind. In FY25 the Board is in the process of recruiting further independent non-executive directors following the decision by Colleen and Russ not to stand for re-election as directors of the Company at the AGM to be held in November 2024.

Succession plans are in place for the senior management talent pipeline which are re-visited and reviewed with the Board as appropriate. The Board takes an active interest in the quality and development of talent and capabilities within Craneware, ensuring that appropriate opportunities are in place to develop high-performing individuals. The learning and development support and initiatives available to employees, including manager advancement, have been augmented in recent years as outlined in the ESG Statement of our 2024 annual report.

Development

The Chair is responsible for ensuring that all the Directors continually update their skills, their knowledge and familiarity with the Group in order to fulfil their role on the Board and the Board’s Committees. Updates dealing with changes in legislation and regulation and financial reporting requirements relevant to the Group’s business are provided to the Board by the Chief Financial Officer and through the Board Committees by the Group’s external auditors and advisors.

All Directors have access to the advice and services of the Company Secretary, who is responsible to the Board for advising the Board on all governance matters, ensuring that Board procedures are properly complied with and that discussions and decisions are appropriately minuted. Directors may seek independent professional advice at the Company’s expense in furtherance of their duties as Directors. The Board ensures that the Audit and Remuneration Committees are provided with sufficient resources to undertake their duties.

Training in matters relevant to their role on the Board is available to all Directors. New Directors, who have not been employed within the Group prior to appointment, are provided with an induction in order to introduce them to the operations and management of the business. All new Directors receive a briefing on their role and duties as a director of a company which has its shares traded on AIM. This briefing is conducted by the Company’s advisers.

Information and Support

In setting the agenda for each Board meeting, the Chair, in conjunction with the Company Secretary, ensures input is gathered from all Directors on matters that should be included. Board papers are then issued in advance of meetings to ensure Board members have appropriate detail in regard to matters that will be covered, thereby encouraging openness and healthy debate. At a minimum, these Board papers include the financial results of the Group and a report from both the Chief Executive Officer and the Chief Financial Officer.

In addition, the non-executive Directors have access to, and correspond with, the Group’s Operations Board on an informal basis. This allows for better understanding of how the strategy set by the Board is being implemented across the Group.

As detailed in the Directors’ Report within our 2024 Annual Report, the Company maintains appropriate insurance cover against legal action brought against Directors and officers. The Company has further indemnified all Directors or other officers against liability incurred by them in the execution or discharge of their duties or exercise of their powers.

Evaluation

In the financial year ended 30 June 2024 a Board evaluation process was conducted by means of a detailed questionnaire completed by each Director. This evaluation included a review of the performance of the Chair and the Board Committees. The results of the process were collated by the Company Secretary on behalf of the Chair and were reviewed by the Board as a whole. Overall, the Board concluded that its performance in the period under review had been satisfactory.

The Board will continue to consider the Code’s recommendation that the evaluation of the Board be carried out with an external evaluator at least every three years, however, at present, remains of the opinion that with the current size of the Board this is not required.

Re-election

Under the Company’s Articles of Association, at every Annual General Meeting (‘AGM’), at least one-third of the Directors who are subject to retirement by rotation, are required to retire and may be proposed for re-election. In addition, any Director who was last appointed or re-appointed three years or more prior to the AGM is required to retire from office and may be proposed for re-election. Such a retirement will count in obtaining the number required to retire at the AGM. New Directors, who were not appointed at the previous AGM, automatically retire at their first AGM and, if eligible, can seek re-appointment.

However, the Board recognises the Code’s recommendation that all Directors should stand for re-election every year, and whilst not a requirement, the Board has decided to adopt this recommendation as best practice. As such, all Directors will retire from office at the Company’s forthcoming AGM. Colleen and Russ have each informed the Board of their intention not to stand for re-election as directors of Craneware plc at the Company’s AGM to be held in November 2024. It is the intention of all of the other Directors to stand for re-appointment.

In determining whether a Director, who wishes to stand for re-appointment, should be proposed for re-election at the 2024 AGM, the Board took into account each Director’s contribution to the Board’s effectiveness, which formed part of the 2024 Board evaluation. This review confirmed that all Directors continue to be effective and demonstrate commitment to their roles and so the Board recommended their re-appointment.

Stakeholder Engagement

Shareholders

Dialogue with Shareholders

The Company engages in full and open communication with both institutional and private investors and responds promptly to all queries received. In conjunction with the Company’s brokers and other financial advisors all relevant news is distributed in a timely fashion through appropriate channels to ensure shareholders are able to access material information on the Company’s progress.

To facilitate this:

- All shareholders are invited to attend the AGM and encouraged to take the opportunity to ask questions.

- The primary point of contact for shareholders on operational matters are Keith Neilson as Chief Executive Officer and Craig Preston as Chief Financial Officer.

- The primary point of contact for shareholders on corporate governance and other related matters is Will Whitehorn as Chair. Colleen Blye, as Senior Independent Director, is available as a point of contact should a shareholder not wish to contact the Chair for any reason.

- The Board welcomes regular engagement with major shareholders to understand their views on governance and performance against our stated strategy.

- The Chair ensures that the Board as a whole has a clear understanding of the views of shareholders.

- The Board aims to ensure that both the investor and analyst communities understand our purpose, strategy, business model and financial and operational performance.

Keith Neilson and Craig Preston meet regularly with shareholders, normally immediately following the Company’s half year and full year financial results announcements, to discuss the Group’s performance and answer any questions. The Board monitors the success of these meetings through anonymous evaluations from both shareholders and analysts performed by the Company’s Broker and Financial PR advisor.

During the year, the Chair of the Board met with shareholders at their request. The Chair is available to answer questions and to meet with shareholders on request.

The Remuneration Committee’s Report section of our 2024 Annual Report explains that, following the results of the executive Director remuneration benchmarking study conducted by the independent adviser, the Committee consulted with the Company’s substantial shareholders (excluding K Neilson and WG Craig). This was specifically in relation to the Committee’s proposals for the changes to elements of executive Director remuneration. No objections were received from those shareholders regarding the proposals. Also, feedback was received from a shareholder during the year regarding one aspect of the performance metrics for executive Directors’ long-term incentive awards which will be addressed in one of the performance metrics to apply to awards proposed to be granted in FY25.

The Board receives questionnaires from some shareholders periodically in relation to ‘Environmental, Social and Governance’ (‘ESG’) matters. These questionnaires are reviewed, now with assistance from the ESG Committee, and then the questionnaires are completed and returned to the requestor.

This website, within the Investors section, includes a Shareholder Centre for investors that contains all publicly available financial information and news on the Company and the Group.

Details of the Company’s share capital and substantial shareholders are contained in the Directors’ Report within the Annual Report. The details of current substantial shareholders are also in the AIM Securities Information section of this website.

Constructive Use of General Meetings

The Board encourages attendance at its Annual General Meeting (‘AGM’) from all shareholders. The Notice of AGM together with all resolutions and explanations of these resolutions are sent at least 20 working days before the meeting. The Company proposes separate resolutions for each substantially separate issue and specifically relating to the report and financial statements. All Directors, where possible, make themselves available to answer any questions shareholders may have. Results of all votes on resolutions are published as soon as practicable on this website.

The voting on each Resolution tabled at the AGM can be conducted on a show of hands or by way of poll votes. Shareholders, if they are unable to attend the meeting in person, are strongly encouraged to participate in the AGM by voting by proxy ahead of the meeting.

If an AGM resolution receives 20% or more of votes cast against, the Board will consult with shareholders to understand the reason behind the result. Following the AGM that was held on 16 November 2023 the Company announced that all resolutions were passed and in respect of each resolution, apart from one, at least 80% of the proxy votes received were ‘for’ the resolutions proposed. However, a number of the votes received opposed the resolution in respect of the reappointment of Colleen as a director of the Company. Following consultation with shareholders during their AGM voting consideration, the Board identified certain concerns regarding the composition of the Board’s Audit and Remuneration Committees. Therefore, with effect from 16 November 2023, Anne McCune replaced Colleen as a member of both the Audit and Remuneration Committees.

Employee engagement

The Board uses alternative workforce engagement mechanisms, instead of the suggested workforce engagement mechanisms in the Code (i.e. a director appointed from the workforce, a formal workforce advisory panel or a designated non-executive director). There are several employee engagement initiatives in place, as outlined in the Our People section within the ESG Statement in our Annual Report. The Group-wide action plan from the FY23 employee engagement survey continued to be advanced through FY24 and regular updates on the progress of the action plan were provided to the Board and to the Operations Board. The Board considers these employee engagement mechanisms to be appropriate at this time, in view of the size of the Group, and that they are supported by the Group’s Chief People Officer, Issy Urquhart, being an executive Director of the Company. The Board will continue to keep these engagement mechanisms, in addition to those for other stakeholders, under review to ensure that the engagement mechanisms are effective.

The Chief People Officer ensures that the Board receives regular reports about a range of factors and issues affecting our employees to ensure that appropriate consideration is given and early action taken where necessary.

As part of the regular agenda for Board meetings, the People strategies, plans, policies, and practices have oversight from the Board through the provision of key people metrics such as retention and engagement metrics and updates on relevant topics such as culture. In addition, qualitative synopses from other lifecycle surveys such as onboarding and exit surveys are also provided to the Board for review and discussion.

The Human Resources team facilitates regular in person Leadership Roundtables. These are sessions for a small group of employees, between 8 to 10, from a cross section of business functions and roles and responsibilities providing an opportunity for face to face discussions with executive leadership. These have provided a two-way feedback opportunity for employees and executive leadership to discuss relevant topics such as culture and engagement as well as business performance and other matters of interest.

Engagement with other key stakeholder groups

The Environmental, Social and Governance (ESG) Statement, the Stakeholder Engagement section and the Directors’ Report within the 2024 Annual Report contain an overview of the engagement with other key stakeholder groups including: customers and the community and bank finance providers.

ESG Committee

Our ESG Committee was established in FY23 and the Board appointed Issy Urquhart, an executive Director of the Company and the Group’s Chief People Officer, to chair the ESG Committee. Although this Committee is a subcommittee of the Operations Board, the Board maintains oversight of the ESG Committee and approved the terms of reference for the operation of the Committee and the Board receives regular updates from the ESG Committee. Further details regarding the ESG Committee and activities during the year are set out within the ESG Statement section of the 2024 Annual Report. A description of the Group’s governance arrangements in relation to assessing and managing climate-related risks and opportunities is contained within the Non-Financial and Sustainability Information Statement in the Annual Report.

Audit, Risk and Internal Control

Audit Committee and Auditors

The Board has established an Audit Committee to assist the Board with the discharge of its responsibilities in relation to internal and external audits and controls. The Audit Committee will normally meet at least twice a year. Throughout the year ended 30 June 2024 and for the period to the date of approval of this Report, the Audit Committee is chaired by David Kemp. Its other members during FY24 were as shown above. The Chief Financial Officer, Chief Executive Officer and other senior management attend meetings by invitation and the Committee also meets the external auditors without management present. David Kemp and Colleen Blye, as current and previous chair of the Audit Committee and a member of the Committee until 16 November 2023, have recent and relevant financial experience and the Audit Committee as a whole has significant experience and competence in healthcare and software sectors.

The terms of reference of the Audit Committee are available here and at the Company’s registered office. Details of how the Audit Committee has discharged its responsibilities are provided below.

Financial and Business Reporting

The Board recognises its responsibilities, including those statutory responsibilities laid out on page 76 of the 2024 Annual Report. An assessment of the Group’s market, business model and performance is presented in the Chair’s Statement and the Strategic Report sections of the Annual Report.

As detailed on page 71 of the Directors’ Report in the 2024 Annual Report, the Board has confirmed that it is appropriate to adopt the going concern basis in preparing the consolidated and Company financial statements for the year ended 30 June 2024. The Board has explained within the Viability Statement section of the Strategic Report in the 2024 Annual Report that it has assessed the prospects of the Company and the Group, taking into account the Group and the Company’s current position and principal risks, as well as projected compliance with debt finance covenants.

Risk Management and Internal Control

Details of the principal risks and uncertainties and emerging risks facing the Group, along with a description of the Group’s risk management procedures, are detailed in the Strategic Report within the Annual Report. The principal financial risks are detailed in Note 3 to the financial statements.

The Directors recognise their responsibility for the Group’s system of internal control and have established systems to ensure that an appropriate and reasonable level of oversight and control is provided. These systems, which cover all material controls, including financial, operational and compliance controls are reviewed for effectiveness annually by the Audit Committee and the Board. The Group’s systems of internal control are designed to help the Group meet its business objectives by appropriately managing, rather than eliminating, the risks to those objectives. The controls can only provide reasonable, not absolute, assurance against material misstatement or loss.

The annual financial forecast is reviewed and approved by the Board. Financial results, with comparisons to forecast results, are reported on at least a quarterly basis to the Board together with a report on operational achievements, objectives and issues encountered. The quarterly reports are supplemented by interim monthly financial information. Forecasts are updated no less than quarterly in the light of market developments and the underlying performance and expectations. Significant variances from plan are discussed at Board meetings and actions set in place to address them. During the financial year and in the period to the date of approval of this report, the Board has received information regarding the Group’s compliance with financial covenants contained within the committed term loan and revolving credit facility. Further details regarding these borrowing facilities are contained in Note 20 to the financial statements.

Approval levels for authorisation of expenditure are at set levels and cascaded through the management structure with any expenditure in excess of pre-defined levels requiring approval from the executive Directors and selected senior managers.

Internal controls and risk management procedures are embedded into the business processes of the organisation and these are subject to review and assessment so that any identified areas of improvement, which come to management’s and the Board’s attention, can be actioned, as appropriate. Metrics and quality objectives continue to be actively implemented and monitored as part of a continual improvement programme. The visibility of regularly updated metrics, across many areas of the business, continues to be enhanced with oversight from the Group’s Transformation team.

There is an extensive complement of policies and procedures, applicable across The Craneware Group, including: business ethics, information security, whistleblowing, anti-corruption and bribery, anti-slavery and human trafficking along with monitoring of mandatory employee training and policy acknowledgement for key areas. This is referred to in the ESG Statement section of the Annual Report.

Audit Committee: role, responsibilities and activities during the year

During the year the Audit Committee, operating under its terms of reference (which are available here and at the Company’s registered office), discharged its responsibilities, including reviewing and monitoring:

- interim and annual reports information including consideration of the appropriateness of accounting policies and material assumptions and estimates adopted by management;

- the integrity of the Annual Report and Financial Statements, the Interim Report and any formal announcements relating to financial performance, to ensure clarity and completeness of disclosures, including those relating to alternative performance measures (including adjusted performance measures);

- developments in accounting and reporting requirements;

- matters of accounting significance, estimation and judgement including in the current year the Prior Year Restatement detailed in Note 26 to the financial statements;

- the systems of internal control and their effectiveness, reporting and making new recommendations to the Board on the results of the review and receiving regular updates on key risk areas of financial control;

- the requirements or otherwise for an internal audit function;

- external auditors’ plan for the year-end audit of the Company and the Group;

- the performance and independence of the external auditors. The auditors provide annually a letter to the Committee confirming their independence and stating the methods they employ to safeguard their independence;

- the audit fees charged by the external auditors;

- the formal engagement terms entered into with the external auditors;

- the provision of tax compliance services to the Group;

- the Committee’s effectiveness.

The Audit Committee has reviewed the Group’s profitability and liquidity as part of a number of forecast scenarios, incorporating the impact of relevant macro-economic conditions. As part of this assessment, the Committee has also reviewed the viability statement and going concern note (as included within the Annual Report for the year ended 30 June 2024), following which it was agreed that the going concern basis of accounting continues to be an appropriate basis of preparation for the financial statements.

In accordance with its terms of reference, the Committee has reported to the Board as to how it has discharged its responsibilities throughout the year.

Significant matters considered in relation to the financial statements

The Committee considers the appropriateness of accounting policies, critical accounting judgements and sources of estimation uncertainty relating to the financial statements. To do this, the Committee reviewed information provided by the Chief Financial Officer and reports from the external auditors setting out its views on the accounting treatments and judgements for the year ended 30 June 2024. The Audit Committee is satisfied that the judgements and estimates applied in the financial statements satisfy the requisite standards both in terms of accounting treatment and disclosure.

The following table sets out the significant areas considered by the Committee in relation to the Group’s financial statements for the year ended 30 June 2024, in particular the critical judgements and estimates of the Company as disclosed in the financial statements:

Area of judgement or estimate | Matter considered and Role of the Committee |

Revenue recognition (Group and Company), including compliance with IFRS 15 | Revenue and deferred income are significant amounts in the context of the Consolidated Statement of Comprehensive Income and the Group and Company Balance Sheets respectively. The amount of revenue to be recognised and timing of revenue recognition are determined based on the details and terms contained in the contracts with customers. Revenue recognition on non-standard contracts can involve significant judgement and interpretation of both the Group’s policy and IFRS 15. |

Internally developed intangible assets (Group and Company) | The Group and the Company capitalise development costs when the conditions for capitalisation, as specified in the principal accounting policies within Note 1 to the financial statements, have been met. Consequently, the Directors are required to continually assess the commercial potential of each product in development and its useful life following launch. There is judgement involved in determining whether or not costs being capitalised meet the definition of intangible assets under IAS 38 Intangible assets. In addition, there may be judgement involved in the assessment of whether or not the intangible assets will generate future economic benefit sufficient to recover the carrying value of the intangible asset. The Committee reviews this area as there is judgement involved in the Directors’ assessment. |

Impairment assessment | Goodwill and other intangible assets, as disclosed in Note 13 to the financial statements, are significant assets on the Group’s balance sheet. The carrying amount of the Group’s and the Company’s tangible and intangible assets, including goodwill on the Group’s balance sheet, is considered at each reporting date to determine whether there is any indication that those assets have suffered an impairment loss. The Committee reviews this assessment. If there is such an indication, the recoverable amount of the asset is estimated in order to determine the extent of the impairment loss (if any) through determining the value in use of the cash generating unit that the asset relates to. Where it is not possible to estimate the recoverable amount of an individual asset, the Group estimates the recoverable amount of the cash generating unit to which the asset belongs. If the recoverable amount of an asset is estimated to be less than its carrying amount, the impairment loss is recognised as an expense. There are no impairment losses recognised in respect of intangible assets in the financial statements of the Group in the year ended 30 June 2024. The Committee received and reviewed reports from both management and the external auditors and, where appropriate, challenged the assumptions taken and the conclusion reached. The Committee reviewed summary reports produced by management detailing the outcomes of the impairment assessment. |

The Group uses Alternative Performance Measures (APMs) and provides additional disclosures, including reconciliations to statutory measures, as set out in Note 27 to the financial statements. The Committee considers it important to take account of both the statutory measures and the APMs when reviewing these financial statements. In particular, items excluded from underlying results were reviewed by the Committee and it is satisfied that the presentation of these items is clear, applied consistently across years and that the level of disclosure is appropriate.

The Audit Committee also reviewed and considered other matters during and in respect of the financial year ended 30 June 2024 including management’s assessment of new accounting standards that were not effective for adoption until after 30 June 2024.

The Audit Committee considered and discussed with the rest of the Board whether the Annual Report, taken as a whole and including the need for and disclosure around the prior year restatement, is fair, balanced and understandable and provides the information necessary for stakeholders to assess the Group’s position and performance, business model and strategy.

Internal audit arrangements

The Committee has also reviewed the arrangements in place for internal audit and concluded, due to the current size, geographical dispersion, complexity and internal control environment of the Company and the Group, that a formal internal audit function was not required. The Audit Committee believes that management is able to derive assurance regarding the adequacy and effectiveness of internal controls and risk management procedures, given the use of the same enterprise resource planning system to maintain financial transaction records across the Group and also the close involvement of the Directors and the senior management on a day to day basis, without the need for an internal audit function.

In view of the importance of the procedures, security, regulation and controls around The Craneware Group’s solutions and customer data, the focus for other assurance activities for the Group is in respect of those areas. Since 2019 The Craneware Group has maintained HITRUST CSF Certification for its Trisus and InSight solutions and corporate services, as well as associated operational processes which is an external, validated audit of Craneware’s security and data privacy practices, as described within the ESG Statement in the 2024 Annual Report. Full HITRUST CSF assessments are conducted every two years; interim assessments are conducted each intervening year. The Craneware Group engages with third party auditors to support effective security practices and compliance with appropriate regulations. We regularly evaluate to ensure our certification selections continue to be the best measure of security controls. Further details regarding information security are provided in the Principal Risks and Uncertainties section and in the Environmental Social and Governance (ESG) Statement within the 2024 Annual Report.

The Audit Committee will continue to monitor whether there is a requirement for an internal audit function and will report accordingly to the Board.

External audit

Under its terms of reference, the Audit Committee is responsible for monitoring the independence, objectivity and performance of the external auditors, and for making a recommendation to the Board regarding the appointment of external auditors on an annual basis. The Group’s external auditors, PricewaterhouseCoopers LLP, were first appointed as external auditors of the Company for the year ended 30 June 2003.

As explained in the Corporate Governance Report section of the annual report in prior years, the Audit Committee was responsible for conducting an audit tender process on behalf of the Board in the year ended 30 June 2021 and, based on the Committee’s assessment of the proposals received from invited audit firms, the Committee made recommendations to the Board. The Board considered the Audit Committee’s recommendation and subsequently approved PricewaterhouseCoopers LLP for recommendation to shareholders, for re-appointment as auditors, at the Company’s Annual General Meeting (AGM) held in November 2021. This resolution for the re-appointment of PricewaterhouseCoopers LLP as the Company’s auditors was approved by the Company’s shareholders.

The audit partner within PricewaterhouseCoopers LLP is required to rotate every five years. This is the fourth year that the audit partner, Paul Cheshire, has led the engagement team for the audit of the Group’s full year financial statements.

The audit plan identified what the external auditors consider to be the key audit risks, the planned scope of work, the audit timetable and also details of how they have assessed their independence to be able to undertake the audit work. This audit plan was reviewed, along with the Committee’s assessment of auditors independence, and was agreed in advance by the Audit Committee. Having considered the planning work carried out and the results of the audit of the Group and Company financial statements for the year ended 30 June 2024, the Committee was satisfied that the approach adopted was robust and appropriate and that auditor independence and objectivity could be relied upon. The Committee is satisfied with the performance of the external auditors and with the policies and procedures in place to maintain their objectivity and independence. The Committee considers that PricewaterhouseCoopers LLP possesses the skills and experience required to fulfil its duties effectively and efficiently and that the audit of the Group and Company financial statements for the year ended 30 June 2024 was effective. The Committee has therefore recommended to the Board the reappointment of PricewaterhouseCoopers LLP as the Company’s auditors at the forthcoming AGM of the Company.

Non-audit services provided by the external auditors

Craneware is an ‘Other Entity of Public Interest’ (‘OEPI’) in accordance with the definition introduced by the Financial Reporting Council and, consequently, the Company’s external auditors are only able to perform a limited number of assurance related non-audit services.

The Audit Committee has implemented procedures relating to the provision of non-audit services by the Company’s auditors, which include non-audit work and any related fees over and above a de-minimis level to be approved in advance by the Chair of the Audit Committee. Subject to the limitations in respect of Craneware being an OEPI, a summary of the policy in respect of non-audit services provided by the external auditors is:

The external auditors may be appointed to provide a limited number of assurance related non-audit services where it is in the Group’s best interests to do so, provided a number of criteria are met. These are that the external auditors do not:

- Audit their own work;

- Make management decisions for the Group;

- Create a conflict of interest;

- Find themselves in the role of an advocate for the Group.

During the year ended 30 June 2024, as was the case in the previous financial year, the Company’s auditors have not provided the Group or the Company with any non-audit work. Details of the fees paid to the auditors for audit services are shown in Note 5 to the financial statements.

Whistleblowing Policy

The Group is committed to conducting its business with honesty and integrity and it is expected that these high standards be maintained throughout the organisation. As an element of providing a supportive and open culture within the organisation, the Group has a Whistleblowing Policy and associated annual training for employees. This Policy includes arrangements by which employees, consultants or contractors may, in confidence and also anonymously should they wish, raise concerns regarding possible improprieties in matters of financial reporting or other matters. These concerns would then be investigated and followed up appropriately. The Board has provision to review these arrangements and any reports arising from their operation.

Remuneration

The Board has established a Remuneration Committee which comprises non-executive Directors all of whom the Board considers to be independent, as described within the ‘Composition of the Board’ section above. The Committee is chaired by Russ Rudish and the membership of this Committee during the financial year is also set out in the ‘Composition of the Board’ section above.

The Committee has responsibility for making recommendations to the Board on the remuneration packages of the executive Directors, the remuneration of the Chair of the Board and setting the level and structure of remuneration for senior management, this includes:

- making recommendations to the Board on the Company’s policy on executive Directors’ and senior management remuneration, and to oversee long-term incentive plans (including share plans);

- ensuring remuneration is both appropriate to the level of responsibility and adequate to attract and/or retain Directors and employees of the calibre required by the Company and the Group; and

- ensuring that executive Director remuneration is in line with current industry practice as well as in line with the internal policies for remuneration for all employees within the Group.

The Committee has presented its Remuneration Report within the 2024 Annual Report, which details the work it has undertaken operating under its terms of reference (which are available here and at the Company’s registered office) to discharge its responsibilities. The Remuneration Committee’s Report also explains the extent of the Board’s compliance with provisions 32 to 41 of the Code.

AIM Rule Compliance Report

The Ordinary Shares of Craneware plc are listed on the Alternative Investment Market (‘AIM’) of the London Stock Exchange and, as a result, the Company has complied with AIM Rule 31 which requires the Company to:

- have in place sufficient procedures, resources and controls to enable its compliance with the AIM Rules for Companies;

- seek advice from its Nominated Advisor (“Nomad”) regarding its compliance with the AIM Rules for Companies whenever appropriate and take that advice into account;

- provide the Company’s Nomad with any information it reasonably requests or requires in order for the Nomad to carry out its responsibilities under the AIM Rules for Companies and the AIM Rules for Nominated Advisors, including any proposed changes to the Board and provision of draft notifications in advance;

- ensure that each of the Company’s Directors accepts full responsibility, collectively and individually, for compliance with the AIM Rules for Companies; and

- ensure that each Director discloses to the Company without delay all information which the Company needs in order to comply with AIM Rule 17 (Disclosure of Miscellaneous Information) insofar as that information is known to the Director or could with reasonable diligence be ascertained by the Director.

In addition, Craneware plc maintains compliance with AIM Rule 26, which specifies a list of information that the Company is required to make publicly available. AIM Rule 26 also requires the Company to adopt a corporate governance code and the Company has chosen the UK Corporate Governance Code 2018, against which the Directors are responsible for reporting the Company’s compliance as set out above and in the Corporate Governance Report section within the Annual Report for the year ended 30 June 2024.

Approved by the Board of Directors and signed on behalf of the Board by:

Craig Preston

Company Secretary

2 September 2024